01 Mar 2024

In his 2023 Autumn statement, the Chancellor announced a reform of the R&D scheme which will be coming into play from 1 April 2024.

The new "Merged R&D scheme"

Currently there are two R&D schemes, one for small companies (SME scheme) and the other for large companies (RDEC scheme). However, from April 2024 the schemes will be merged into one R&D Merged Scheme which is broadly in line with the current RDEC scheme for large companies.

There is always an exception to the rule and this applies to companies which qualify as “R&D Intensive”. These companies will be able to remain with the current SME scheme – see below “SME R&D Intensive Scheme”

R&D Expenditure Credit (RDEC) – the basics

Many companies will have been using the SME scheme until now and will be unfamiliar with how the RDEC scheme works.

The RDEC scheme gives an “above the line” tax credit, currently 20% of the qualifying R&D expenditure. The credit is essentially a grant from the Government which is accounted for above the line as other income and is chargeable to corporation tax at the prevailing rate (19% or 25% subject to marginal relief).

Where a company is loss making, or the credit is greater than the actual tax liability the tax credit may be payable to the company in certain circumstances.

When does the new merged R&D scheme take effect?

The merged scheme will take effect for accounting periods beginning on or after 1 April 2024.

Therefore, a company with a 31 March 2024 year end will join the scheme beginning from 1 April 2024. However, a company with a 29 February 2024 year end will not join the merged scheme until 1 March 2025.

SME R&D Intensive Scheme

The R&D Intensive Scheme was introduced from 1 April 2023 and was aimed at loss making SME companies which spent 40% of their total expenditure on R&D.

From 1 April 2024, the threshold to qualify has been reduced to 30% and this will enable more companies to remain within the SME R&D Intensive Scheme.

Companies that qualify as R&D Intensive are able to uplift their total R&D qualifying expenditure by 86% following which a credit is granted at a rate of 14.5%.

SME Scheme Vs Merged Scheme

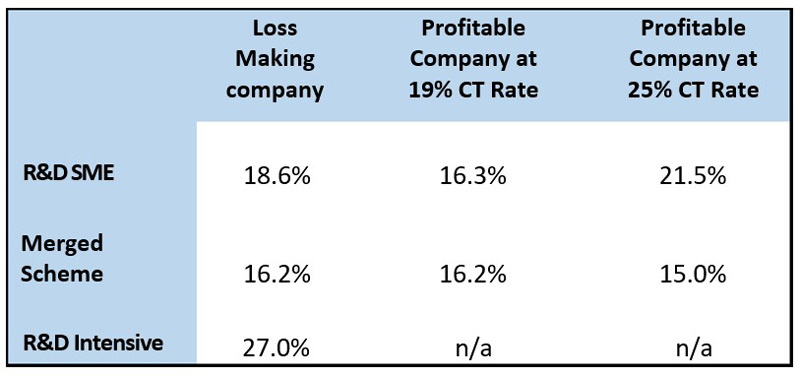

The impact of the scheme change and the decision on which scheme is more beneficial will depend on whether a company is loss making or profitable.

- Loss Making Companies

As can be seen in the table below, loss making companies are generally better off staying with the current SME R&D scheme for as long as possible; the old scheme gives a net benefit of 18.6% compared to 16.2% on the new merged RDEC scheme.

Companies that qualify as R&D intensive will receive the highest net benefit at 27.0% and should therefore elect for the R&D Intensive Scheme as soon as they qualify.

However, note that there are some instances where the new merged scheme can produce a higher benefit than the SME scheme or the R&D intensive scheme, and therefore it is important to model the figures on case by case basis in order to ascertain the best result.

- Profitable Companies

Profitable companies that previously claimed under the SME regime will be worse off under the new Merged R&D scheme.

As can be seen above, the current SME scheme offers more generous relief than the merged scheme for both profitable and loss-making companies.

It may therefore be worth considering changing year ends in order to delay the onset of the merged scheme but companies must consider any other ramifications of changing year end.

Qualifying Expenditure – widened for periods beginning on or after 1 April 2023

For accounting periods beginning on or after 1 April 2023, the qualifying expenditure definition has been widened to include data licensing and cloud computing expenditure.

By way of example, a company with a year end of 31 December 2023 will not be able to claim R&D relief on cloud computing or data licensing costs in that period because they fall within a period beginning before 1 April 2023. However, they will be able to claim those costs as part of their R&D expenditure for the year ending 31 December 2024 and beyond.

Overseas Expenditure – restricted

This change was announced to take effect in April 2023 but was delayed by 12 months and has now been confirmed to start for accounting periods commencing on or after 1 April 2024.

The restriction prevents companies from benefitting from R&D relief where the R&D is subcontracted out to overseas companies. The idea is to encourage businesses to undertake their R&D in the UK and therefore contribute to the wider economy.

The only exception is if the work needs to be subcontracted overseas because of geographical, environmental or social conditions; or legal or regulatory requirements which prevent the work from being undertaken in the UK.

Key takeaways

- If your company is loss making, consider whether it qualifies as R&D intensive? If 40% of expenditure is R&D qualifying then the company can join the R&D Intensive Scheme from 1 April 2023. If only 30% is expended, it can join the scheme from 1 April 2024.

- If the company doesn't qualify as R&D intensive, consider whether there is a benefit to changing the company's year end to take advantage of the greater relief under the old SME scheme.

- Be aware of the introduction of new qualifying expenditure that may be relevant to your claim.

- Be mindful of the new restriction as regards R&D subcontracted overseas and consider whether changes in year end could be beneficial to the value of an R&D claim and to defer the impact of this change.